Below we’ve compiled eleven of the best finance management strategies to help you better understand how to manage business finances before and during your business venture. Preparing ahead of time is also the best way to avoid tax season stress. For tax advice on your unique business needs, consult a reputable accountant. More importantly, good financial management habits can help you protect your small business so that it has a chance to last for many years to come.

- Yet whether those funds start out as personal investments, loans from family or friends, revenue your business generates, or business financing, it’s critical to spend those funds wisely.

- In some cases, we earn commissions when sales are made through our referrals.

- Forecasting allows you to plan and make better decisions regarding investments or expansions that may affect your bottom line in the long run.

- It records revenue when money comes in and expenses when money goes out.

- Making payroll can be a challenge for many small businesses, even if they’re bringing in enough revenue.

- Once you’ve built a solid foundation, learn how to read the four key financial reports below to monitor your business’ financial health.

There are many professional payroll management services and more businesses are choosing to outsource the task. Find one that fits your budget and relieve yourself of the strenuous responsibility. Many business owners feel intimidated by the financials when writing their business plan. However, it doesn’t require a business degree or advanced math skills to create accurate financial statements.

Discover the world’s #1 plan building software

This approach allows a business to gauge its financial standing at any given point. A well-planned budget can also empower a business to set realistic goals and create the motivation it needs to reach them. what is a 12 month rolling forecast This practice reduces bookkeeping confusion, makes it easier to budget, and can help you to develop your business credit rating. Maintaining separate finances might also help protect you from personal liability (aka “piercing the corporate veil”) if a creditor ever tries to sue your small business in the future.

Don’t be afraid of loans.

Tracking the right business metrics is crucial for understanding the health of your business. To help celebrate businesses paving their way forward, we partnered with Forbes on the Next 1000 initiative to spotlight bold entrepreneurs and share their most valuable lessons. By sharing firsthand experiences, we’re helping businesses celebrate resilience, build skills, and explore what’s next. See how Square works, and get more expert guidance for the next era of small business.

When employees can get paid soon after they earn it, whether it’s weekly or instantly, they can make more informed financial decisions. Once you’ve built a post a cash receipts journal to a general ledger solid foundation, learn how to read the four key financial reports below to monitor your business’ financial health. Companies are not required to report trades to the authorities in charge of creditworthiness. If only a fraction of your vendors are reporting each payment, you may have a short credit history which will end up being harmful to your overall score. Learn how to stay on top of your financial performance by reviewing your financial statements and comparing actual results to your forecasts.

Improve your financial literacy.

The resulting statement from calculating the cash accrued through all these means is your net cash flow. With which business attire can be a business expense this statement you can provide analysts and investors with a clear portrait of all the transactions going through your business. The cash flow statement is arguably the most intuitive financial statement you can make due to the totality of understanding it provides you with.

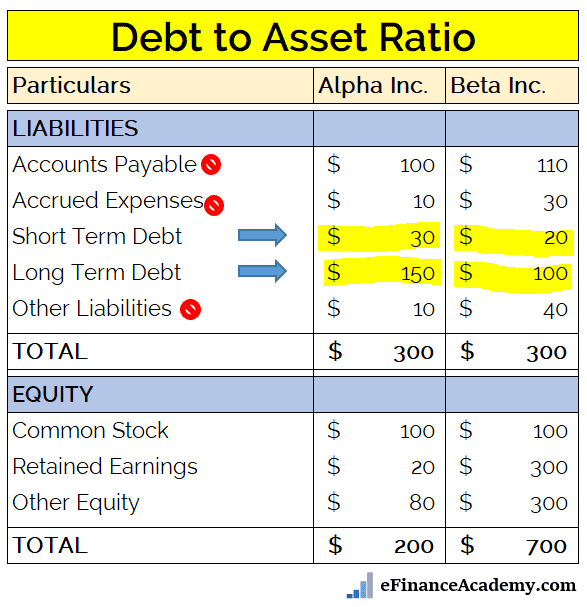

It also shows your equity — the difference between assets and liabilities — which is the amount of money you would be left with if you sold all business assets and paid off all business debts. Luckily, you can strengthen your financial skills—even if you’re not a numbers person. This guide collects resources covering small business financial topics critical to growth.

Alongside whatever monthly payments you put aside for yourself, invest what you can into future plans for your business. These plans can be for expansion of the business into new areas, increases in staff, new feature roll-outs, projected earnings—anything you would consider growth in relation to your business. Before you think about budgeting and forecasting, you need to set up your business finances. This guide covers mapping your startup costs, opening a bank account, setting up accounting and payroll, and much more.